First of all, before opening an inheritance case to obtain a certificate of inheritance in future, you must collect a package of documents. Whereas each and any inheritance case is individual and inherits a series of specific peculiarities, we strongly recommend to turn to a notary for professional advice in order to know what documents are required and ensure that nothing is omitted.

In the process of inheritance formalisation, documents are collected in two stages, which are the following: the first stage — when you collect required documents to open an inheritance case, and the second stage — when you collect required documents to actually formalise a certificate of inheritance at the notary’s office.

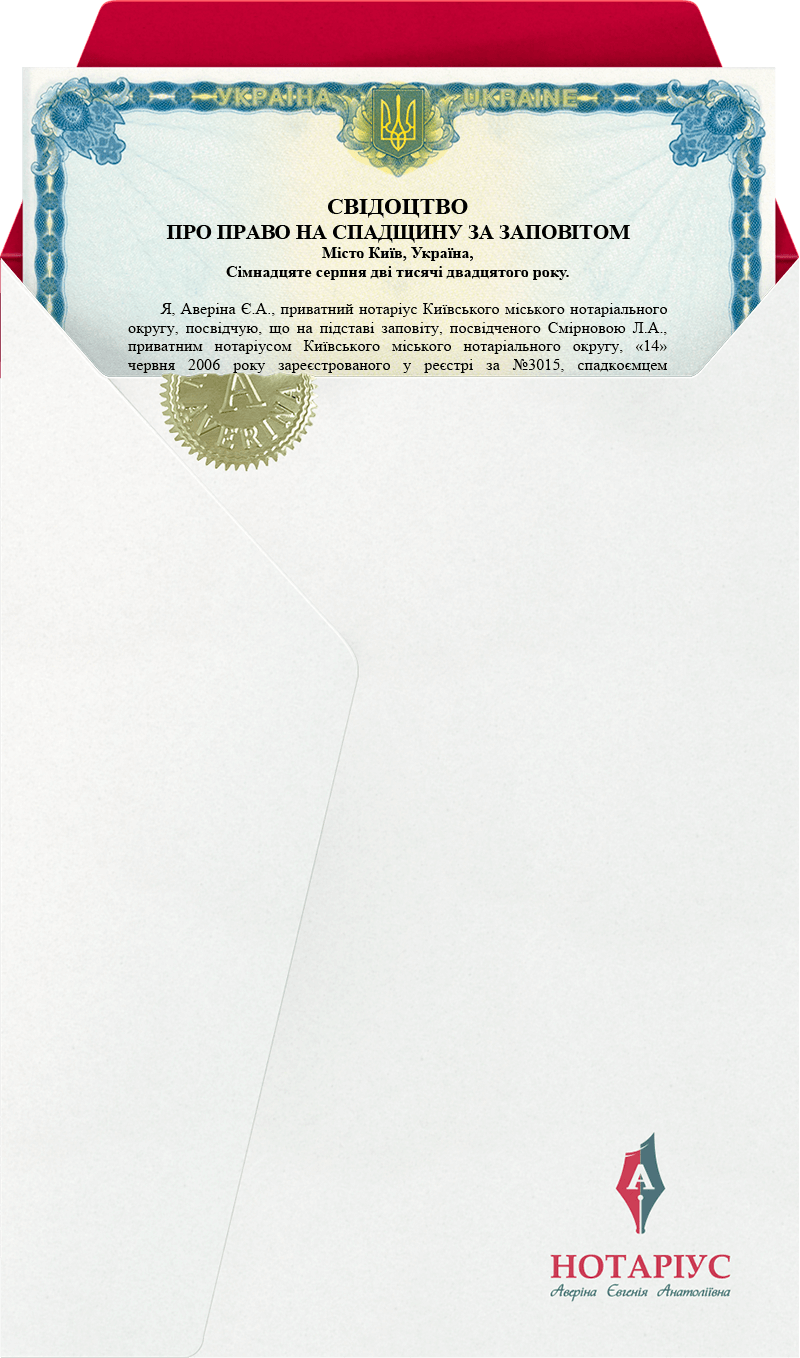

If you have all of the listed documents at hand, an inheritance case may be opened. A notary will draw up a respective statement on acceptance/waiver of inheritance, and an inheritance case will be opened based on such statement. Then, a notary must register your inheritance case in the Inheritance Register. If it becomes known in the process of registration that another notary has already opened the same inheritance case, a notary shall not open another similar inheritance case, but send an heir to visit such notary who opened an inheritance case.

To obtain the certificate of inheritance, you are required to additionally provide the following documents (list of documents depends on the assets to be inherited):

- Identification documents of an heir;

- Documents on property the certificate to which you are planning to obtain (certificate of an apartment privatization or apartment purchase agreement, as well as a technical certificate for an apartment, or for a vehicle, etc.);

- Assessment of real estate or vehicle (in case an heir is obliged to pay tax on inheritance formalisation);

- Power of attorney, if an heir is acting via his/her representative;

- Identification documents of an agent under the power of attorney.

When all of the listed documents are submitted, a notary is drawing up a statement being the basis for a certificate of inheritance, which is to be obtained by you.

This article includes a standard list of documents that may be required, but each specific case may require additional certificates, documents, inquiries, etc. Therefore, a notary’s advice prior to initiating an inheritance case is a must.