Probably, everyone contemplates on a question, who is going to use my property when I pass away? Well, if you want to avoid such thoughts, you may turn to a notary and draw up a document, such as a last will and testament. Let’s gain an insight into the issue of inheritance by will and testament.

A last will and testament is a personal instruction of a natural person in the event of his/her death. Thus, a testator must visit a notary personally and formalise his/her last will and testament. A last will and testament may be formalised for relatives and for persons with no kin relationships, both for the property you own or will own at the moment of death, and for specific object. And the most interesting thing is that a testator may not only transfer his/her property according to the last will and testament, but also deprive any of the heirs of the right of inheritance.

A testator may state a legacy in a last will and testament, for example, after a testator’s death, an heir gains a title to an apartment, but this heir will be also obliged to give another person a right to use this apartment.

If you want an heir to do anything (enter a university, relocate to specific place, etc.), you may draw up a last will and testament with such specific condition stated in it. For example, if you grandchild enters a higher educational establishment, then he/she receives an inherited apartment. We must mention that a condition stated in a last will and testament must be in effect at the moment of testator’s death.

Spouses who own any property on the right of joint ownership may draw up their joint last will and testament for such property. After the death of one spouse, the respective share in the ownership right is transferred to the spouse alive, and after the death of the second spouse an heir by will and testament gains a right to formalise an inheritance and receive a certificate of inheritance.

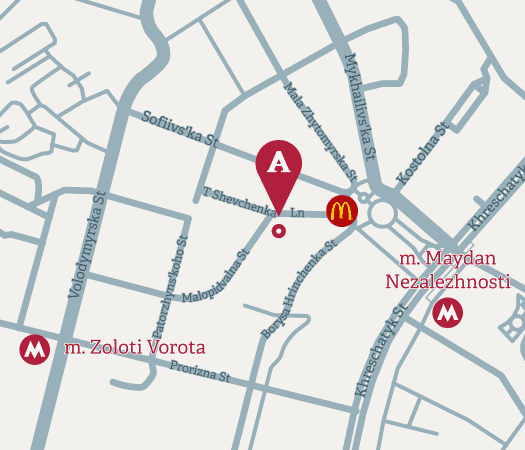

Prior to drawing up any will and testament, you should seek some professional notarial advice; a notary will help you to make everything clear to account for your wishes in the document.