The procedure of registration of a natural person-entrepreneur can take lots of time and energy. Many people decide to entrust a lawyer with this procedure. If you are one of them, you should be aware of the following.

Please note that a power of attorney may be formalised not only for launching of a natural person-entrepreneur, but also for management of your business as a natural person-entrepreneur in future.

Such power of attorney may include powers regarding the execution of the state registration of amendments in your personal information, receipt of patents, licenses, permits, opening of accounts in bank institutions, payment of taxes, representation of your interests in relationships with the governmental authorities and institutions or local authorities.

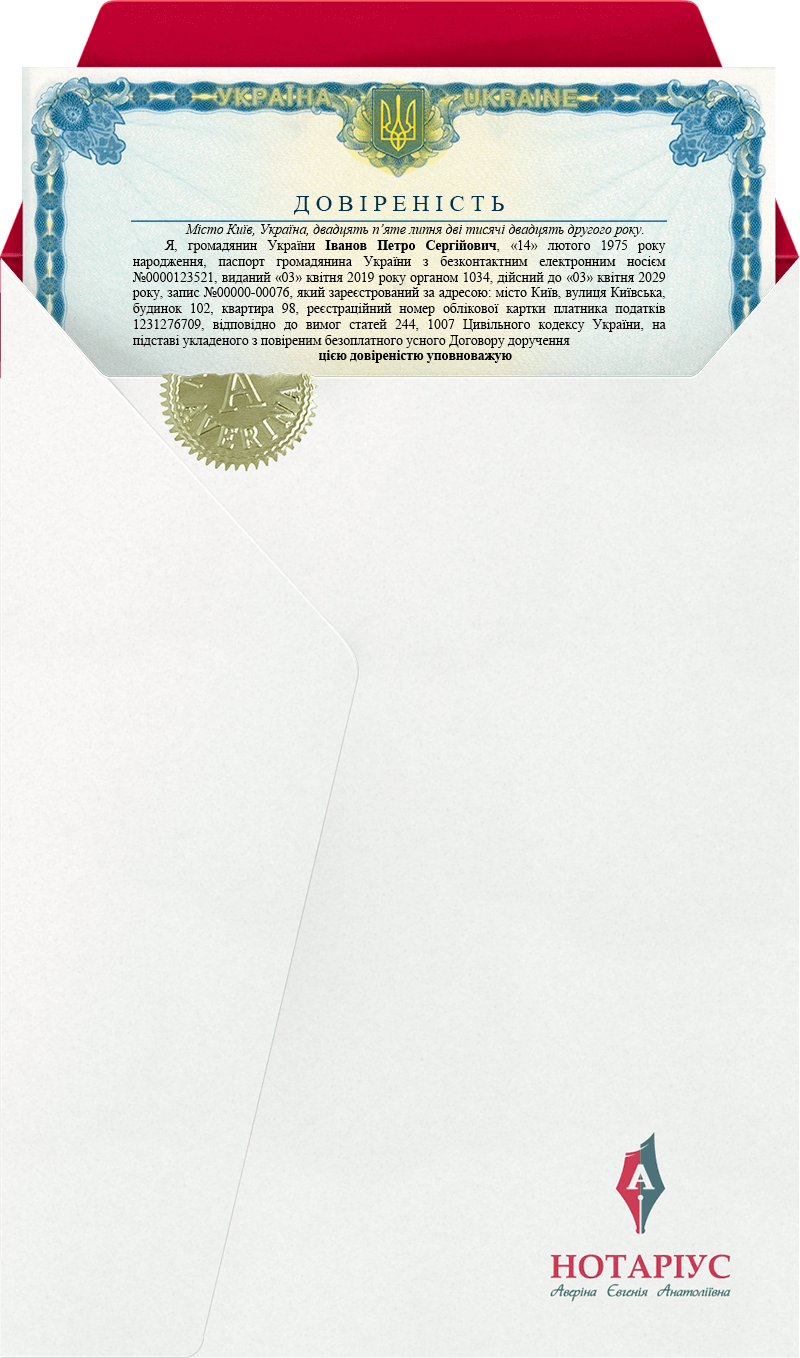

We recommend that you, being the principal under a power of attorney, should also notarise several copies of a power of attorney right after its original notarisation because an attorney may require them to exercise his/her powers. One copy of the power of attorney you must keep for yourself, whereas if you want to cancel this power of attorney, it would be easier for a notary to find it in the Unified Register of Powers of Attorney and make a record on cancellation.

A power of attorney for registration of a natural person-entrepreneur includes information on an attorney (full name and registered place of residence; his/her passport details and registration number of the taxpayer identification card (formerly called individual taxpayer number) may be additionally indicated). Therefore, to notarise a power of attorney, you need to provide a notary with the information stated above.

Under a power of attorney, you may transfer your powers either to one or several persons who will act independently from each other.