At present, in view of the current complicated economic situation, citizens often formalise such document as a power of attorney for representation of interests at the Deposit Insurance Fund.

Let’s consider a few aspects that should be taken into account when formalising a power of attorney for representation of interests at the Deposit Insurance Fund:

- You must remember that such power of attorney should explicitly stipulate the powers of an attorney to represent your interests at the Deposit Insurance Fund and bank institutions that are determined by the former as agent banks, whereas you may not know exactly which bank is going to effect payments.

- It is important to provide for a right of an attorney to receive amounts of money at the Deposit Insurance Fund and at bank institutions, which are its partners.

Please note that some banks require an excerpt from the Unified Register of Powers of Attorney on the registration of the power of attorney to be presented with the power of attorney.

We recommend to notarise several copies of a power of attorney right after its original notarisation because an attorney may require them to exercise his/her powers. One copy of the power of attorney you must keep for yourself, whereas if you want to cancel this power of attorney, it would be easier for a notary to find it in the Unified Register of Powers of Attorney and make a record on cancellation.

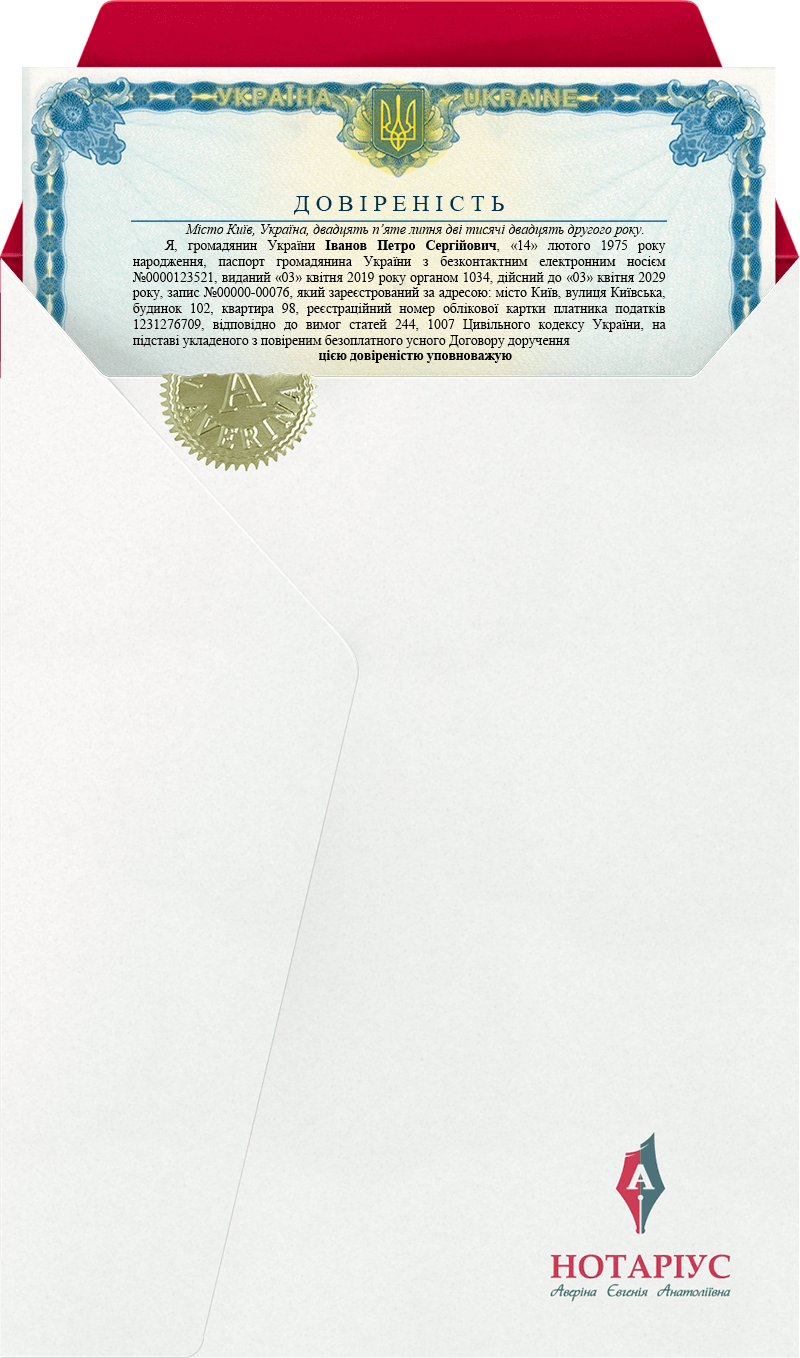

A power of attorney for representation of interests at the Deposit Insurance Fund includes information on an attorney (full name and registered place of residence; his/her passport details and registration number of the taxpayer identification card (formerly called individual taxpayer number) may be additionally indicated). Therefore, to notarise a power of attorney, you need to provide a notary with the information stated above.

A power of attorney may be used to grant powers to either one or several designated persons at the same time, who will be entitled to act jointly and independently from each other.