If you have a ready-made business idea, you should set up your own business by registering as a natural person-entrepreneur before implementing it. The beginners who set up their own business for the first time have to rely only upon their knowledge and financial savings. To set up a business, you should clearly determine its legal form and other aspects.

What is Registration as a natural person-entrepreneur? General features

Before you start registering, you should make out the terminology. Some words and abbreviations may be misinterpreted both in various platforms and in ordinary life, which can result in mistakes and a significant waste of time.

The term “private entrepreneur” is widely used with the “natural person-entrepreneur” meaning. But “private entrepreneur” has a broader meaning. A legal entity can also be a private entrepreneur, so it’s not always correct to use private entrepreneur as a synonym for natural person-entrepreneur. Natural person-entrepreneur is an individual entrepreneur represented by citizens of Ukraine, foreign residents, and stateless persons. This term implies entrepreneurial activity carried out in Ukraine under existing legislation of the country. The wording Registration as a natural person-entrepreneur in Kyiv is often used, which means a Ukrainian private entrepreneur.

Natural person-entrepreneur (NPE) means being engaged in private enterprise without forming a legal entity.

Registration as a natural person-entrepreneur in Ukraine can take a lot of beginner’s time, effort and even finance. We recommend that you carefully study the legislation on this matter.

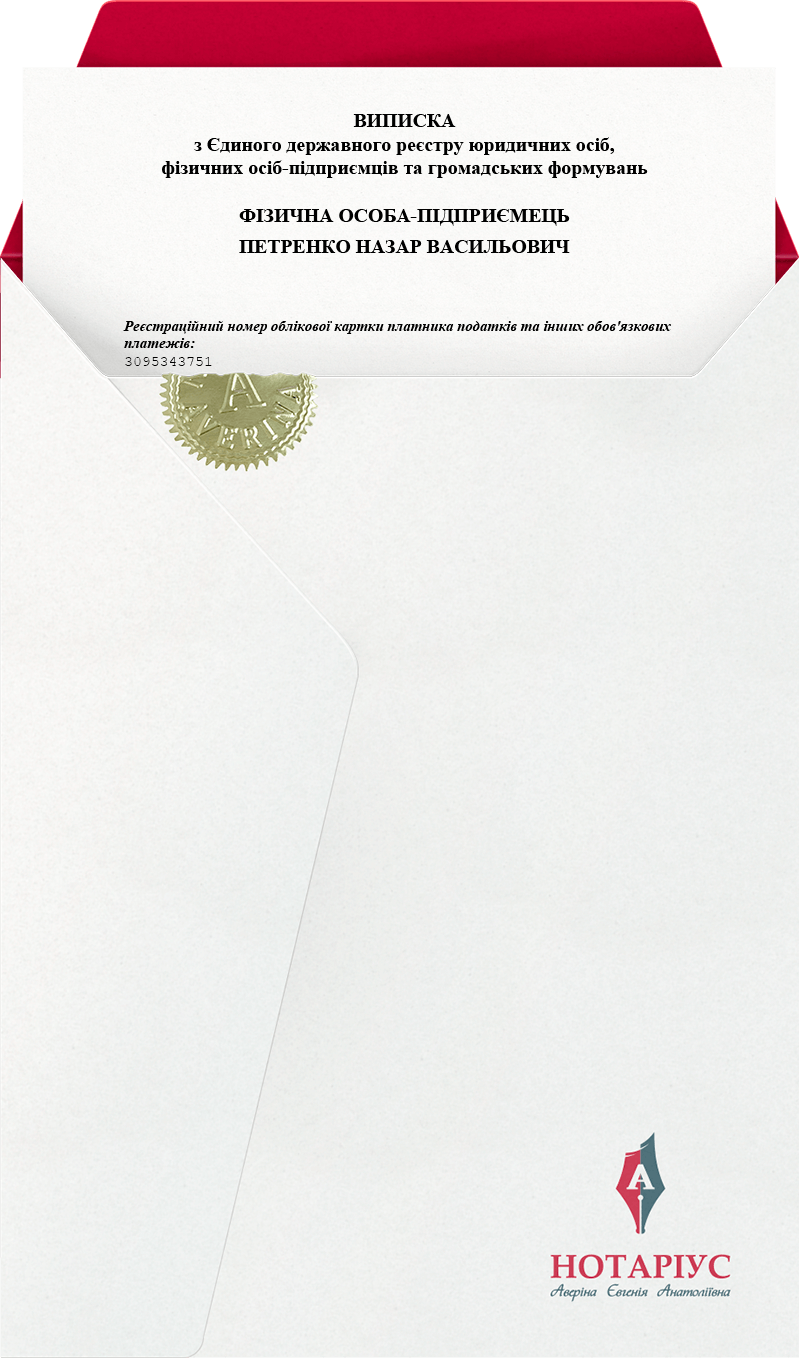

According to the law, notaries can handle the registration of a natural person-entrepreneur in Kyiv. The future entrepreneur himself/herself chooses to register NPE on his own or contact a notary.

Selection of KVED and taxation system for a natural person-entrepreneur

The first step for the future entrepreneur is to determine the code by KVED (Ukrainian Industry Classification System). Registration as a natural person-entrepreneur has an advantage over a legal entity — a simplified tax payment system.

Under the laws of Ukraine, there are certain restrictions that prohibit natural person-entrepreneurs from engaging in certain types of activities. For example, you cannot engage in currency exchange, carry out postal services, etc. You can find out the full list of restrictions from the Internet or by phone consultation with lawyers.

The simplified tax system in Ukraine has 3 special groups into which entrepreneurs are divided:

- 1 group. The total annual profit of an entrepreneur is limited to 300 thousand hryvnias. The use of wage labour is excluded. Kinds of activity: retail trade, the provision of domestic services.

- 2 group. The amount of annual profit is limited to 1.5 million hryvnias. A team of up to 10 people can be hired. This group of persons provides services to ordinary consumers and single tax payers, as well as engaged in the production, sale of goods, catering.

- 3 group. The annual profit is up to 5 million hryvnias. There are no restrictions on the number of employees. It is allowed to provide any services and sell goods to the public and legal entities with any tax system.

For each group, a specific tax amount or rate is determined.

Registration as a natural person-entrepreneur in Ukraine: who can become an entrepreneur?

Entrepreneurship under Ukrainian laws is available to all citizens. Both the citizens of Ukraine and foreigners, as well as stateless persons can get a registration as a natural person-entrepreneur. At the same time, entrepreneurial activity is carried out in the territory of Ukraine. Registration as a natural person-entrepreneur in Kyiv is possible even for underage person. It is important that the entrepreneur is 16 years old and has permission from the parents.

Foreign citizens residing in the territory of Ukraine should provide relevant documents. Registration as a natural person-entrepreneur in Kyiv can be done by attorney. For this, the notary is presented with a power of attorney, passport and TIN of an attorney. In this case, it is also necessary to present a natural person-entrepreneur registration card with the filled data.

Registration as a natural person-entrepreneur in Kyiv: features

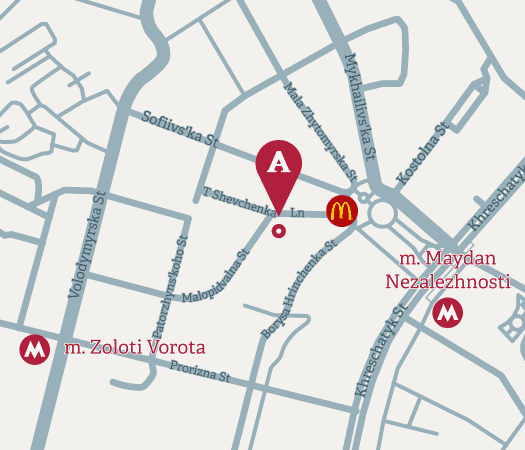

If you decide to do business, you should know that you can be registered as a NPE at the place of registration. That’s why, paperwork in Kyiv is possible only for persons, officially registered in the capital.

To register a business, the first you need to do is to prepare an application. At first glance, such a procedure could seem easy, requiring no help. In practice, future businessmen are faced with the fact that their documents are not considered. This suggests that there is a discrepancy with the prescribed requirements or the data are not completely entered. Incorrect application form becomes an obstacle for being registered as a natural person-entrepreneur.

The notary public executes in accordance with the national requirements. He/she will review the submitted materials for reasons for refusal. The most common reasons are: data mismatch, restrictions on certain types of activities, or incorrect choice of tax group. There are frequent cases when a refusal is given because a person is already registered as an entrepreneur.

Registration as a natural person-entrepreneur in Ukraine at the notary

Today, a private notary in Ukraine is vested with the rights of a state registrar. Thanks to this, registering a natural person-entrepreneur has become a simple and transparent procedure that is accessible to everyone. You can draw up all the documents, choose a taxation method and register as a natural person-entrepreneur at a notary public.