You want to present a house you own to your children, grandchildren or other lucky person, but you have no idea what to do under such circumstances? Let’s have a little insight into the procedure.

Firstly, we must state that donation, or a gift, as it is commonly called, is drawn up in the form of a notarized deed of gift. The main discrepancy between a deed of gift and other agreements is its GRATUITOUS nature. When a deed of gift is concluded, your ownership right is ceased, and it arises for a donee; in turn, the donee is not obliged to any actions in your favour.

Whereas a deed of gift is a gratuitous agreement, you may not oblige a donee to fulfil any actions in your favour, material or non-material.

When formalizing a deed of gift of a house, one should not forget about a land plot where a house is located. Our legislation stipulates no instances when a land plot is owned by one person and a house located in it by the other person.

In case a land plot is privatized and belongs to a house owner, the title to the house must be re-registered simultaneously with a title to a land plot. I.e. apart from a deed of gift of a house, you need to formalize a deed of gift of a land plot.

A land plot may be assigned to a house owner for temporary use from communal ownership. In such case a deed of gift of a house includes the description of this land plot, its cadastral number; there is no need to formalize a separate deed of gift of a land plot.

Currently, when notarizing a deed of gift of a house, a notary simultaneously registers an ownership right of a new owner in the State Register of Proprietary Rights to Immovable Property. I.e. a donee leaves a notarial office as a rightful owner of a house, and there is no need for you to register your ownership right at any other authorities.

In the process of notarization of a deed of gift, a notary carefully examines all documents submitted to conclude the deed, existence of any freeze or prohibition of alienation of the respective house, the validity of the power of attorney (if an agreement is concluded by an attorney).

It should be mentioned that for notarization of a deed of gift where the parties are the immediate family members (according to the legislation, those are parents, spouse, children, including adopted children) an income received as a gift is subject to zero rate taxation. If a deed of gift is in favour of other persons, a tax amount equals 5%.

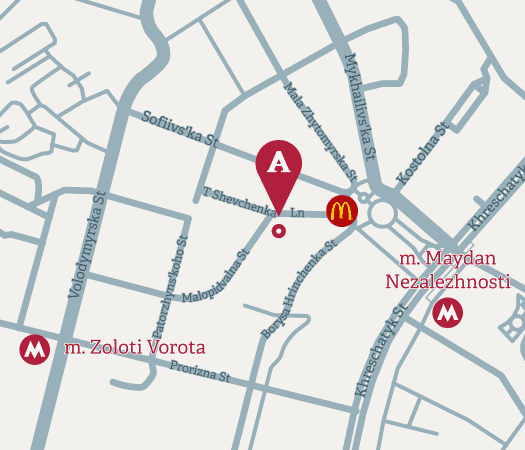

Please note that both a Donor and a Donee must apply to a notary to conclude a deed of gift. Their attendance in person at the moment of deed is a prerequisite to its notarization.