What is Deed of Gift for an apartment?

According to the law, you can give even big property, including square meters. Statistically, Ukrainians mostly draw up Deed of Gift for an apartment. This action provides for the complete transfer of property rights from one person to another.

According to Ukrainian law, if you give away your apartment a Deed of Gift is drawn up. According to the document, residential square meters are transferred to another person on a pro-bono basis. The donor is not entitled to demand anything in return. This is one of the main differences between donating property and the sale and purchase procedure.

Under a gift agreement, you can also transfer only a part of an apartment. If the total living space has been acquired during the marriage, the consent of the second spouse to perform a notarial procedure is necessary for drawing up and signing an agreement.

What documents are necessary for Deed of Gift for an apartment execution?

For the purity of the procedure and validation of an agreement, the document is drawn up by a notary. The notary checks the availability and compliance of all documents with established standards. Upon signing, the authenticity of signatures is also established on the submitted papers.

At the notary’s office, you can also draw up a power of attorney. The document shall indicate the validity of the power of attorney in order to avoid ambiguous interpretation. A notary in Kyiv will provide legal services in accordance with the law. This will allow you to dispose of the property in the interests of the principal.

Deed of Gift for an apartment in Ukraine is executed against presentation of the above documents.

After the deed of gift, the notary public enters the new owner into the State Register of Proprietary Rights to Immovable Property. It is not necessary to register the title for the donee.

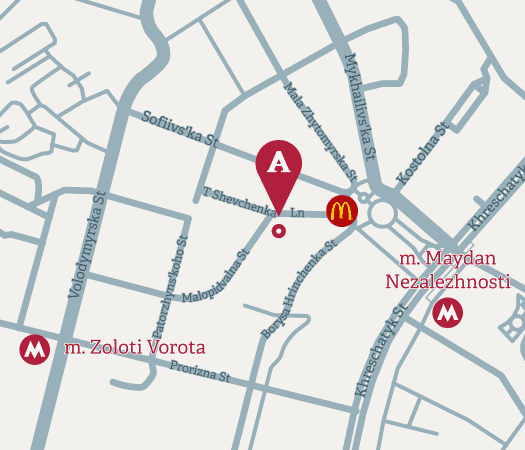

The choice of a notary depends on the place of registration of one of the parties to an agreement or the location of an apartment. For example, if an apartment is in Kyiv, and one of the parties lives in Irpin, and the other in Brovary, you have to turn to any notary from one of the 3 cities.

Deed of Gift for an apartment: peculiarities

One of the main issues that arise during the Deed of Gift execution is the degree of kinship. The 1st and 2nd degree relatives are exempt from the donor’s tax. These include children, parents, siblings, and grandparents. If you make gifts to other people with whom you have no blood ties, a tax will be relevant. Its amount is paid by the donee.

We should keep in mind that there are additional duties and taxes if one of the parties to an agreement is a non-resident of Ukraine.

Deed of Gift for an apartment: additional conditions

One can transfer an apartment as an outright gift with a certain condition. We remind you that the procedure implies donation, in which the donee does not pay money to the donor in exchange for square meters.

The document may indicate that the registered relative will live in the apartment. In this case, you cannot evict or remove a person from the registry. The deed may also come into effect from a certain date or time. For example, parents can transfer property to their child after his/her marriage. You can also specify a certain date: in 2 years.

In this case, it must be borne in mind that the deed will be cancelled in the event of one of the parties’ death before the document is brought into force. It is worth weighing the pros and cons of making such conditions.

Is it possible to dispute the deed?

The law provides for opportunities at which, after registration of the Deed of Gift for an apartment, the contract can be disputed. The donor may terminate the gift in court if:

- An agreement was signed under threat or duress;

- A donee has committed a crime towards a donor or his/her relatives;

- The fact of gift turned out to be a deal; money for an apartment was received;

- The donor was tricked;

- The first homeowner was admitted to having a mental illness, which made him/her incapable during signing the document.

You can sue within a year after the parties have signed the agreement. You can also terminate the deed by mutual agreement of the two parties.

It is worth remembering that the notary checks the availability and statutory compliance of all papers, as well as the authenticity of signatures during the gift of property execution. For all the rest, only the signatory parties are responsible.