A loan agreement entitles a lender to transfer ownership of money, but also any other items with generic characteristics (i.e. items that are measured by number, weight) to a lendee, and a lendee, in turn, is obliged to repay the amount of money stated in the agreement or return similar items in the stated amount and equal quality. Let’s consider a money loan agreement.

Such money loan agreement may be made by the parties either in written or by word of mouth. If the parties wish so, such type of agreement may be notarized. If an amount of loan under the agreement exceeds the amount of non-taxable minimum income of citizens prescribed by the law in ten times, the agreement must be drawn up in written. If an amount is significant, we recommend that such agreement is notarized.

An agreement is considered to be concluded at the moment of money transfer to the lendee. There are no specific requirements to the content of the agreement; it is sufficient to state the parties to the agreement, the amount of money transferred and the period. If the amount of money is to be repaid in instalments, the due dates of payments and liability of the lendee for omission thereof may be also stipulated by the agreement.

Please note that in case of overdue payment of an instalment by the lendee for any reason, the lender may demand the repayment of loan in full prior to the agreement expiry date.

The loan is considered as repaid immediately at the moment of money repayment to the lender. To protect the lendee’s (person who receives a loan) rights, we recommend to state the fact of full repayment of money in the lender’s statement, with his/her signature notarized.

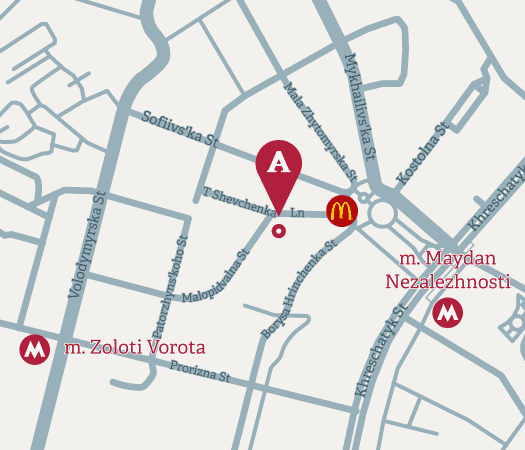

Prior to conclusion of a loan agreement, consult with a notary or a lawyer to think over and include all necessary provisions in the agreement, thus protecting your rights.