First of all, we must clarify that coming into inheritance is actually acceptance of inheritance.

It is a very complicated process that requires specific actions on the part of an heir. The fact of testator’s death itself does not mean that now heirs are entitled to dispose of an apartment or a car which belonged to the deceased. For the heirs to be considered as those who officially accepted inheritance and are entitled to sell, present or in any other way use the property, owned by inheritance, at their own discretion, they are obliged to turn to a notary (notarial office), to have a notary open an inheritance case, and obtain a certificate of inheritance which is required to effect any further actions with the property.

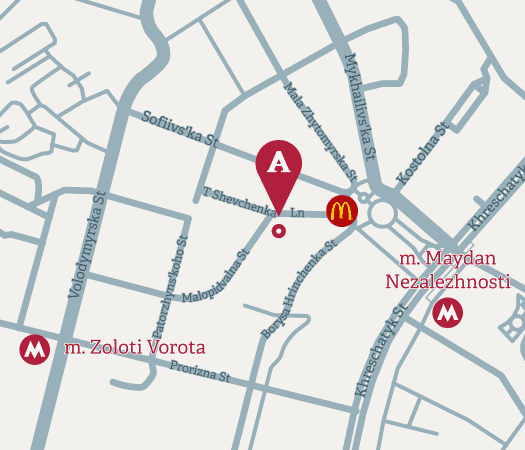

Moreover, a notary, to whom you must turn to within the prescribed period, i.e. 6 months from the date of testator’s death, shall be of the last place of residence of the deceased. If an heir failed to do so within the prescribed period for any reason, such heir deems to be forfeited of the right to inheritance, and the only solution in such situation is to apply to the court to adjudge the extension of the period for acceptance of inheritance, either by lay or by will and testament.

If you are one of those heirs included in a will and testament, and you think that after the testator’s death you will be able to dispose the inheritance stated in a will and testament, and there is no need to turn to a notary as regards to this matter and accept the inheritance, unfortunately, you are totally wrong. A will and testament is just a document which states the last will of a person when alive, but this document grants you no rights to dispose any property, because it is not a document of entitlement by its nature. There are no exceptions for such heirs, so both heirs by law and by will and testament must turn to a notary within 6-month period in order to come into inheritance.

Please note!

Having opened an inheritance case and then obtained a certificate of inheritance, an heir may eventually rest assured, whereas this heir is considered to be a rightful owner!